“An investor who will study values and market conditions, and then exercise enough patience for six men will likely make money in stocks.”

Bridge The Gap.

90% of traders fail. This is a fact. But why?

We believe retail traders are not given the lens that they need to view the market with the same clarity as the institutional level participant.

Market Mavericks was founded with the goal of providing retail investors and traders a bridge for the gap between them and the professional finance world.

We have developed a proven process to obtaining market clarity.

Our “lens” has been polished using three main concepts:

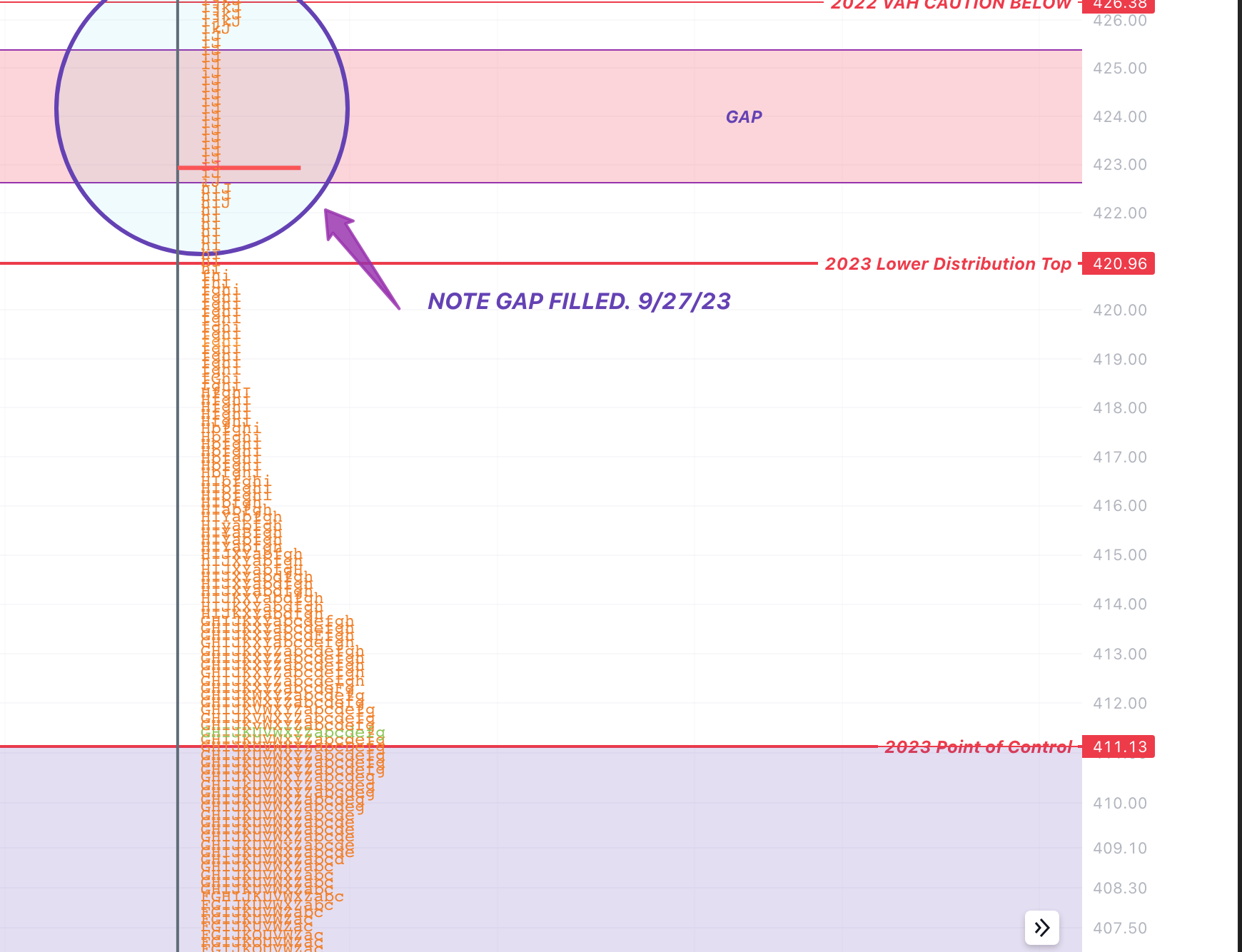

Our Proprietary Method for Long Time Horizon Price Distribution Analysis (Utilizing Market Profile)

Mutli-Time Frame Order Flow Analysis

DOW/Wyckoff Theory and Market Structure

Combing these three pillars we track capital markets during both regular trading hour sessions (09:30-16:00 EST) along with the AH/GlobeX Futures Sessions (18:00-09:30EST) providing accurate substantial “market generated information” to our clients around the world.

We provide one on one consultation services on top of daily market insights and news alerts with regards to concrete price objectives in a given underlying market.

For the majority of our commentary and forecasting; We focus on the E-Mini S&P-500 Continuous Contract, as it is the most heavily traded market arguably in the world. With the S&Ps sitting nicely between the DOW and NASDAQ with respect to price action and transaction volume; we believe this gives us the best advantage to our clients looking for an overall MACRO view of the US Capital Markets at any given time.

We cater all services to each client individually. Reach out to us directly to see what we can do for you.